Knowing what you need is the first step to finding the right plan.

When it comes to health insurance, one size doesn’t fit all. What works for your neighbor might not be the best choice for you. That’s why it’s crucial to understand your specific health needs before diving into the marketplace.

Assess Your Health Status

Chronic conditions: Do you have any ongoing health issues like diabetes, heart disease, or asthma? These conditions might require specialized coverage.

Consider Your Lifestyle

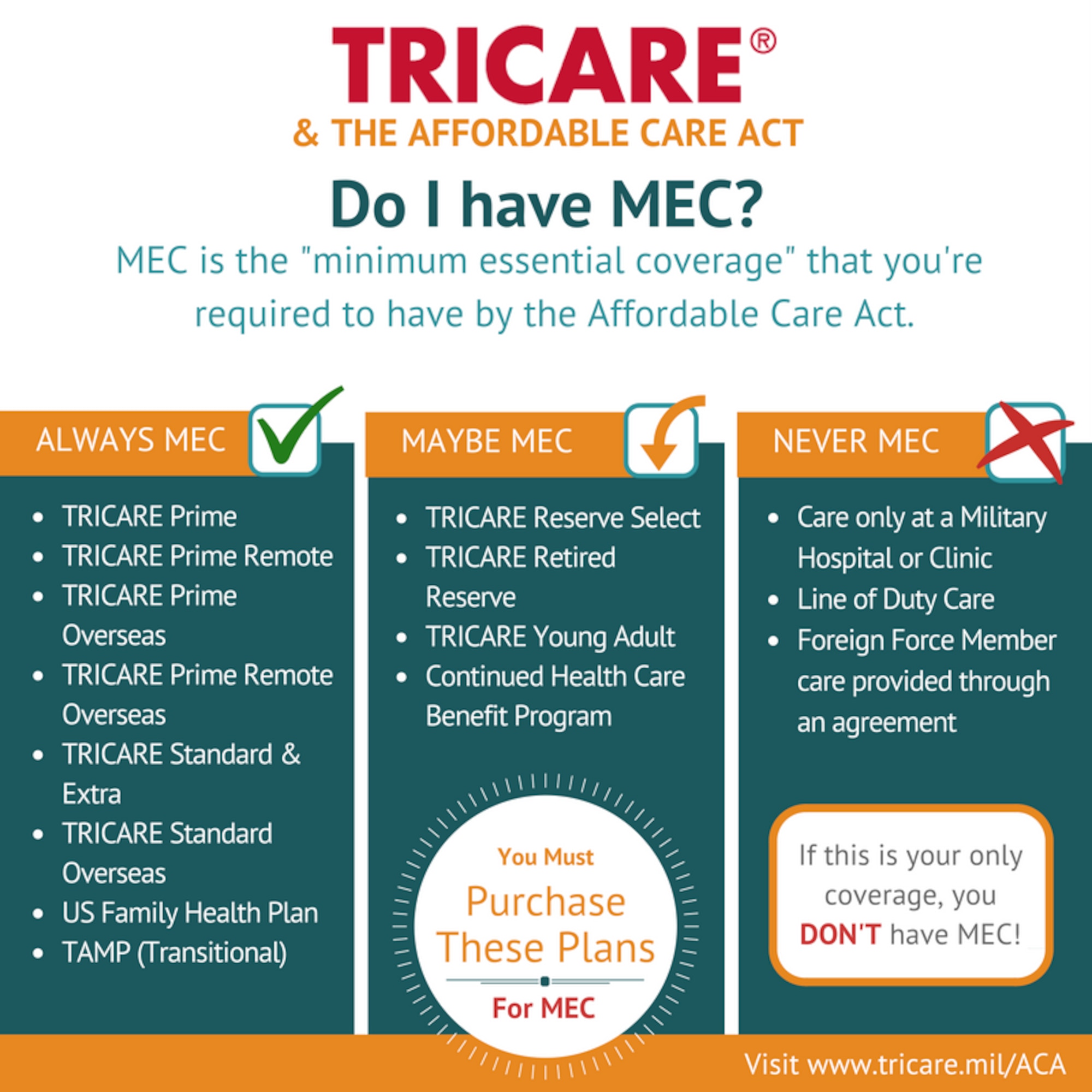

Image Source: defense.gov

Travel: Do you frequently travel out of state or country? Ensure your plan has coverage for emergencies and routine care while you’re away.

Evaluate Your Future Needs

Pregnancy: Are you planning to start a family soon? Maternity and newborn care can be expensive, so check for plans that offer adequate coverage.

Understanding Your Health Insurance Needs

Once you have a clear picture of your health needs, lifestyle, and future plans, you’re ready to start exploring the health insurance marketplace. By taking the time to understand your unique requirements, you can make informed decisions and find a plan that best suits your needs and budget.

Choosing the right health insurance plan can feel like navigating a labyrinth, especially if you’re new to the process. With so many options and terms to understand, it’s easy to get overwhelmed. But fear not! This guide is here to help you make informed decisions and find a plan that fits your needs and budget.

Assessing Your Health and Lifestyle

The first step to selecting the right health insurance is to evaluate your health and lifestyle. Consider the following factors:

Your age: As you get older, your healthcare needs may change. Factors like chronic conditions, preventive screenings, and prescription medications become more important.

Determining Your Budget

Once you’ve assessed your needs, it’s time to set a budget. Consider your monthly income and expenses to determine how much you can afford to spend on health insurance premiums. Remember that premiums can vary depending on factors like your age, location, and health status.

Understanding Key Terms

To make informed decisions, it’s essential to understand some key terms:

Premium: The monthly fee you pay for your health insurance coverage.

Choosing a Plan

Now that you have a better understanding of your needs, budget, and key terms, you can start exploring different plan options. Here are some factors to consider:

Network: The network is the group of doctors, hospitals, and other healthcare providers that your insurance company has contracted with. Choose a plan with a network that includes providers in your area.

Additional Considerations

Open enrollment: This is the annual period when you can enroll in or change your health insurance plan.

By following these steps and understanding your options, you can confidently navigate the health insurance marketplace and find a plan that meets your needs and budget. Remember, taking the time to research and compare plans will pay off in the long run.

Health Insurance Marketplace: How to Enroll