1. Affordable Care Act (ACA) Basics

Understanding the Foundation

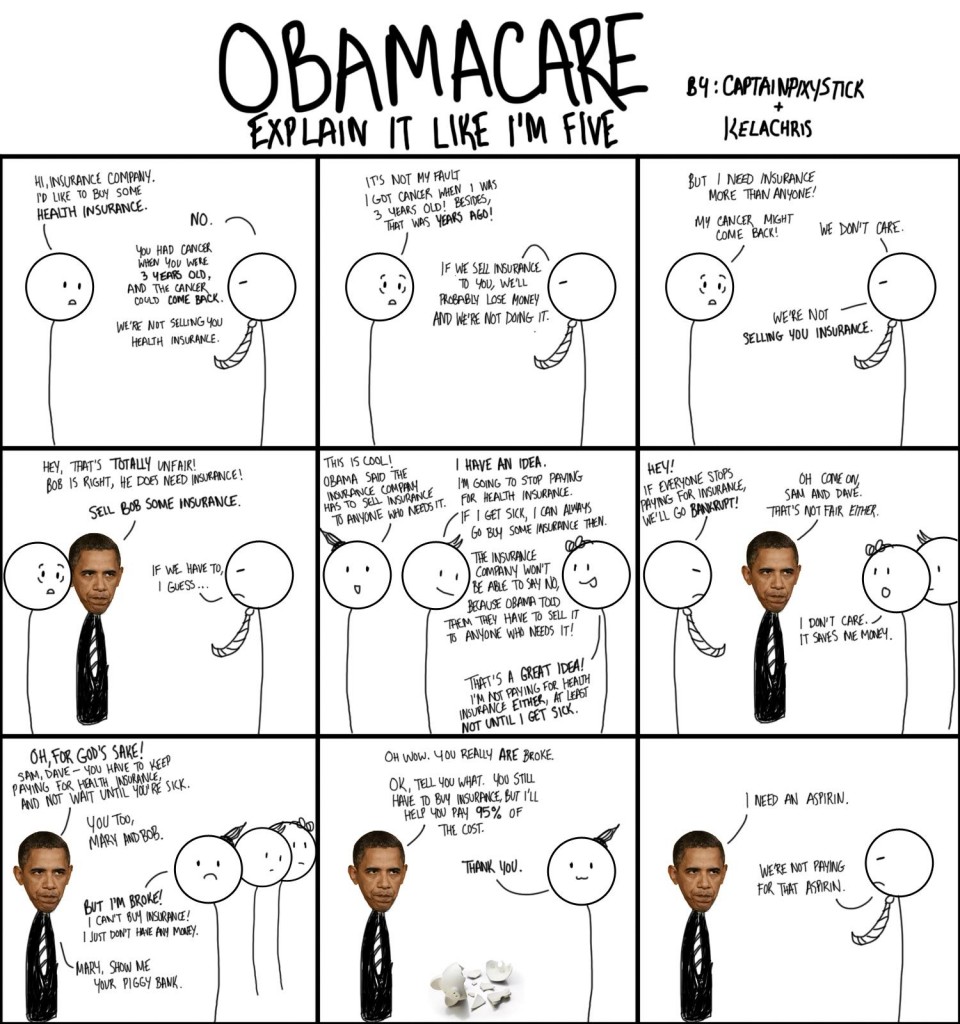

The Affordable Care Act (ACA), often referred to as Obamacare, is a landmark piece of legislation that has significantly reshaped the American healthcare landscape. Signed into law in 2010, its primary goal is to make healthcare more accessible and affordable for all Americans.

Key Components

At its core, the ACA introduced several key components:

Image Source: obamacarefacts.com

Health Insurance Marketplaces: These online platforms provide a centralized marketplace where individuals and families can shop for health insurance plans that meet their needs and budgets.

A Complex Puzzle

The ACA is a complex piece of legislation that has been subject to numerous changes and interpretations since its passage. Understanding its intricacies can be challenging, but it’s essential for anyone seeking to navigate the healthcare system.

The Benefits

For many Americans, the ACA has provided significant benefits:

Increased Coverage: Millions of people have gained health insurance coverage through the ACA, reducing the number of uninsured Americans.

The Challenges

Despite its successes, the ACA has also faced challenges:

Rising Costs: The cost of health insurance premiums has continued to increase for many people, raising concerns about affordability.

As the healthcare landscape continues to evolve, it’s important to stay informed about the ACA and its implications for individuals and families. By understanding the basics of the law, you can make informed decisions about your healthcare coverage and take advantage of the opportunities it provides.

2. Tax Credits and Subsidies: A Financial Lifeline

One of the most significant and impactful features of the Affordable Care Act (ACA), often referred to as Obamacare, is the provision of tax credits and subsidies. These financial aids are designed to help individuals and families who meet certain income eligibility requirements afford health insurance coverage. Think of them as a helping hand, making healthcare more accessible to a wider range of people.

How Do Tax Credits Work?

Tax credits are essentially reductions in your federal income tax liability. They can be claimed on your annual tax return. The amount of the tax credit you’re eligible for depends on your income and the cost of health insurance plans available in your area. The higher your income, the smaller the tax credit you’ll receive. Conversely, lower-income individuals can qualify for substantial tax credits that can significantly reduce the cost of their health insurance premiums.

Subsidies: A Complementary Approach

In addition to tax credits, the ACA also offers subsidies. These are direct payments made to health insurance companies on your behalf. Subsidies can be used to lower your monthly premiums, making health insurance more affordable. The amount of the subsidy you’re eligible for is based on your income and the cost of health insurance plans in your area.

Who Qualifies for Tax Credits and Subsidies?

To be eligible for tax credits and subsidies, you generally need to meet the following criteria:

Income: Your income must fall within certain limits. The exact income thresholds vary depending on your family size and geographic location.

A Real-Life Example

Let’s consider a hypothetical example. Imagine you’re a single parent with two children. Your annual income is $35,000. Without tax credits and subsidies, the cost of a health insurance plan that meets your family’s needs might be too high for you to afford. However, with the help of these financial aids, you might be able to find a plan that fits within your budget.

The Impact of Tax Credits and Subsidies

The introduction of tax credits and subsidies has had a profound impact on the healthcare landscape. It has helped millions of Americans gain access to affordable health insurance coverage. Prior to the ACA, many people were uninsured or underinsured due to high costs. The financial assistance provided by the ACA has made it possible for these individuals to get the care they need.

Furthermore, the availability of tax credits and subsidies has encouraged more people to participate in the health insurance marketplace. This has led to increased competition among health insurance companies, which has ultimately resulted in lower premiums for consumers.

In conclusion, tax credits and subsidies are a cornerstone of the Affordable Care Act. They provide a lifeline for individuals and families who struggle to afford health insurance. By making healthcare more accessible and affordable, these financial aids have improved the overall health and well-being of millions of Americans.

Obamacare Explained: What You Need to Know