Insurance 101: A Beginner’s Guide to Coverage

Insurance. It’s a word that often sends shivers down our spines, conjuring images of complex paperwork, hefty premiums, and a whole lot of confusion. But fear not, intrepid insurance explorer! We’re here to guide you through the labyrinth of insurance terminology and help you understand the basics of coverage.

What is Insurance, Anyway?

Think of insurance as a safety net. It’s a financial agreement between you and an insurance company where you pay a regular fee (called a premium) in exchange for the company’s promise to cover certain losses or damages. In essence, you’re spreading the risk of unforeseen events across a large pool of people.

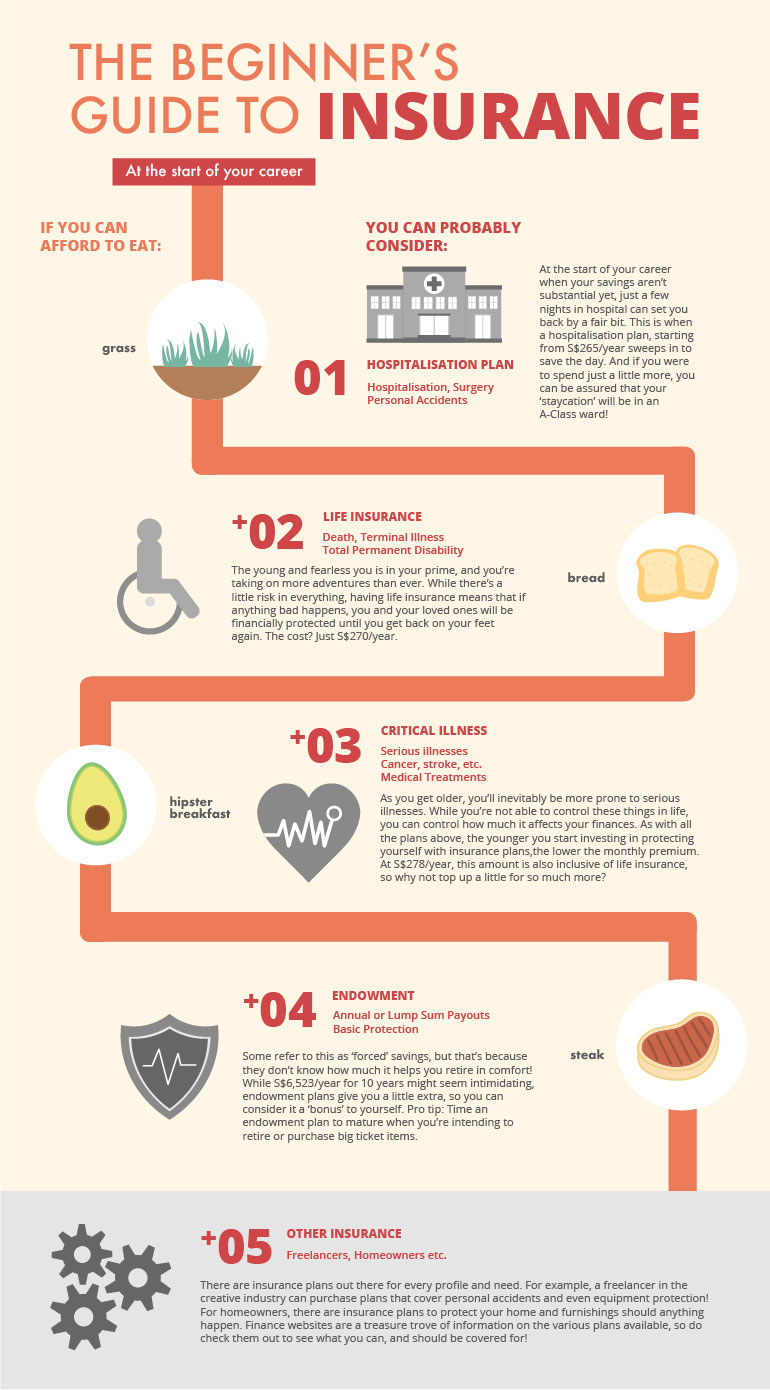

Types of Insurance: A Quick Overview

Image Source: frankbyocbc.com

There are many different types of insurance, each designed to protect specific assets or situations. Here are a few common ones:

Auto Insurance: Protects you and your vehicle in case of accidents or theft.

Understanding Insurance Policies

When you purchase an insurance policy, you’re entering into a legal contract with the insurance company. This contract outlines the terms and conditions of your coverage, including:

Premiums: The amount you pay to maintain your policy.

Choosing the Right Insurance

Selecting the right insurance coverage can be overwhelming, but with a little research and planning, you can find a policy that meets your needs and budget. Consider the following factors when making your decision:

Your lifestyle: What are your biggest risks? Do you own a home? Do you have a car? Do you have health issues?

Tips for Saving on Insurance

Shop around: Get quotes from multiple insurance companies to compare prices and coverage options.

Remember, insurance is a valuable tool that can provide financial protection in unexpected circumstances. By understanding the basics of coverage and making informed decisions, you can ensure that you’re adequately protected for the future.

Life Insurance: A Safety Net for Your Loved Ones

Life insurance is often seen as a complex financial product, but at its core, it’s a simple concept: protecting your loved ones financially in the event of your unexpected passing. It’s like a safety net, providing a lump sum of money to help them navigate life’s challenges without the added burden of financial stress.

Types of Life Insurance

There are two primary types of life insurance: term life and whole life.

Term Life Insurance: This is a temporary policy that provides coverage for a specific period, usually 10, 20, or 30 years. If you die during the term, your beneficiaries receive the death benefit. If you outlive the term, the policy expires. Term life insurance is generally more affordable than whole life, making it a popular choice for those who want coverage for a specific period.

Choosing the Right Life Insurance Policy

When selecting a life insurance policy, consider the following factors:

Your Needs: How much coverage do you need to adequately protect your loved ones? This will depend on factors such as your income, debts, and dependents.

Life Insurance Riders

Many life insurance policies offer additional riders that can enhance your coverage. These riders can include:

Accelerated Death Benefit: This rider allows you to access a portion of your death benefit while you are still alive if you are diagnosed with a terminal illness.

Life Insurance: A Vital Investment

Life insurance is not just a financial product; it’s a testament to your love and responsibility for your loved ones. By investing in life insurance, you are ensuring that they will have the financial resources they need to cope with the unexpected.

Remember: Life insurance is a personal decision. It’s essential to consult with a qualified insurance agent to find the policy that best suits your needs and budget.

A Beginner’s Guide to Insurance: Everything You Need to Know