Understanding the Basics

When you purchase car insurance, you’re essentially buying a safety net to protect yourself and your vehicle from unexpected accidents. One of the key components of this safety net is the deductible, a sum of money you agree to pay out of pocket before your insurance company covers the rest of a claim. It’s like a small co-pay for your car insurance.

The Higher the Deductible, the Lower the Premium

One of the most common misconceptions about deductibles is that they’re a fixed cost. In reality, the amount you pay in premiums is directly related to your deductible. The higher your deductible, the lower your premium will be. This is because insurance companies assume that you’re less likely to file claims if you have to pay more out of pocket.

Weighing the Pros and Cons

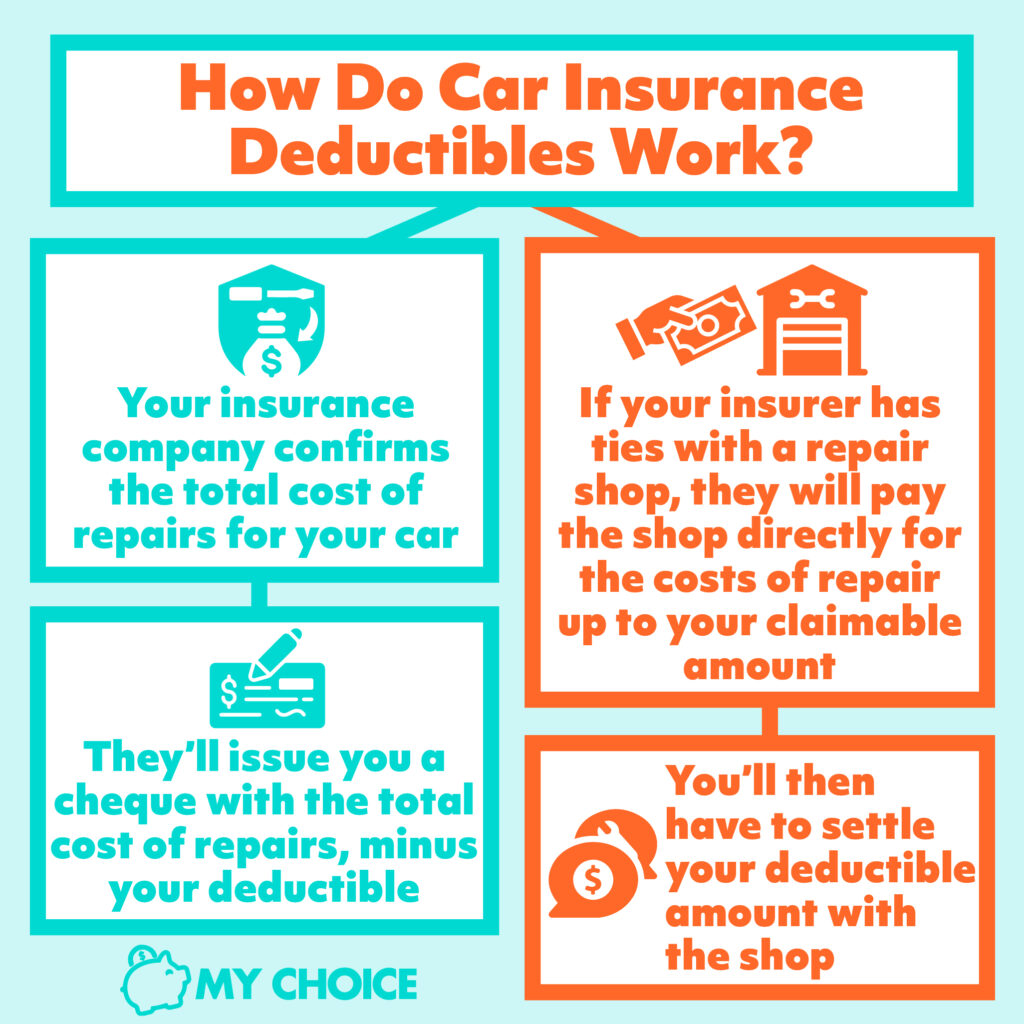

Image Source: mychoice.ca

Choosing the right deductible is a balancing act. On one hand, a higher deductible can save you money on premiums. On the other hand, it means you’ll have to pay more out of pocket if you’re involved in an accident.

Here are some factors to consider when choosing a deductible:

Your financial situation: If you have a healthy emergency fund, a higher deductible might be a good option. However, if you’re living paycheck to paycheck, a lower deductible could provide some peace of mind.

Beyond the Basics: Understanding Deductible Waivers

In addition to the standard deductible, some insurance companies offer deductible waivers. These waivers can be a valuable addition to your policy, as they can help you avoid paying out-of-pocket costs for certain types of accidents.

Here are some common types of deductible waivers:

Collision deductible waivers: These waivers can help you avoid paying a deductible for accidents involving your car and another object.

A Note on Deductible Waivers

While deductible waivers can be a valuable addition to your policy, it’s important to understand that they’re not always a guarantee. Some insurance companies have restrictions on when deductible waivers can be used, and you may still have to pay a deductible for certain types of accidents.

Choosing the Right Deductible for You

The best deductible for you will depend on your individual circumstances. It’s important to carefully consider your financial situation, the likelihood of accidents, and the value of your car before making a decision. By understanding the basics of deductibles and deductible waivers, you can make an informed choice and protect yourself from unexpected costs.

Understanding Deductibles: The Cornerstone of Car Insurance

When it comes to car insurance, deductibles often play a pivotal role. It’s a term that many of us have heard, but may not fully grasp. Essentially, a deductible is the amount you’re responsible for paying out of pocket before your insurance coverage kicks in. This means that in the event of a claim, you’ll need to cover the initial costs up to the deductible amount before your insurer steps in to cover the rest.

The Higher the Deductible, the Lower the Premium

One of the most common misconceptions about deductibles is that they’re solely determined by the insurance company. In reality, you have a significant say in the matter. When purchasing car insurance, you’ll typically be presented with options for different deductible amounts. The higher the deductible you choose, the lower your premium will be. This is because insurance companies are essentially betting that you won’t file a claim. If you’re confident in your driving abilities and believe that accidents are unlikely, opting for a higher deductible can save you money on your premiums.

Weighing the Pros and Cons

While a higher deductible can lead to lower premiums, it’s important to consider the potential downsides. If you were to get into an accident and need to file a claim, you’d be responsible for covering the deductible amount yourself. This could be a significant financial burden, especially if the damage is extensive. Therefore, it’s crucial to carefully evaluate your financial situation and risk tolerance before making a decision.

Factors to Consider When Choosing a Deductible

Several factors can influence your choice of deductible:

Your Financial Situation: If you have a substantial emergency fund, you may be more comfortable with a higher deductible. However, if your finances are tight, a lower deductible might be a safer option.

Deductibles and Comprehensive Coverage

Deductibles are not only applicable to collision coverage but also to comprehensive coverage. Comprehensive coverage protects you against losses due to theft, vandalism, natural disasters, and other non-collision incidents. The same principle applies here: a higher deductible typically results in a lower premium.

Additional Considerations

When considering deductibles, it’s also essential to understand the following:

Multiple Claims: Some insurance companies may increase your premiums if you file multiple claims within a specific period. This is why it’s important to drive defensively and avoid accidents whenever possible.

In Conclusion

Choosing the right deductible for your car insurance is a personal decision that depends on your individual circumstances. By carefully considering your financial situation, driving record, and the value of your vehicle, you can make an informed choice that balances affordability with protection. Understanding deductibles is a crucial step in ensuring you have the right insurance coverage to safeguard your investment and your peace of mind.

Understanding Car Insurance Deductibles