In the unpredictable tapestry of life, unforeseen events can disrupt our plans and challenge our financial stability. Critical illness insurance, a relatively underappreciated financial tool, emerges as a beacon of hope, offering a much-needed safety net during times of adversity. This comprehensive guide will delve into the intricacies of critical illness insurance, shedding light on its significance and benefits.

What is Critical Illness Insurance?

Critical illness insurance is a type of life insurance policy that provides a lump sum payout if you are diagnosed with a specific critical illness. Unlike traditional life insurance, which pays out upon death, critical illness insurance is designed to offer financial support while you are still alive and facing the challenges of a serious illness.

Why is Critical Illness Insurance Important?

Critical illnesses can significantly impact your quality of life and have devastating financial consequences. Medical expenses, lost income, and other related costs can quickly deplete your savings. Critical illness insurance can provide a lifeline during these challenging times, offering much-needed financial relief and enabling you to focus on your recovery without the added burden of financial stress.

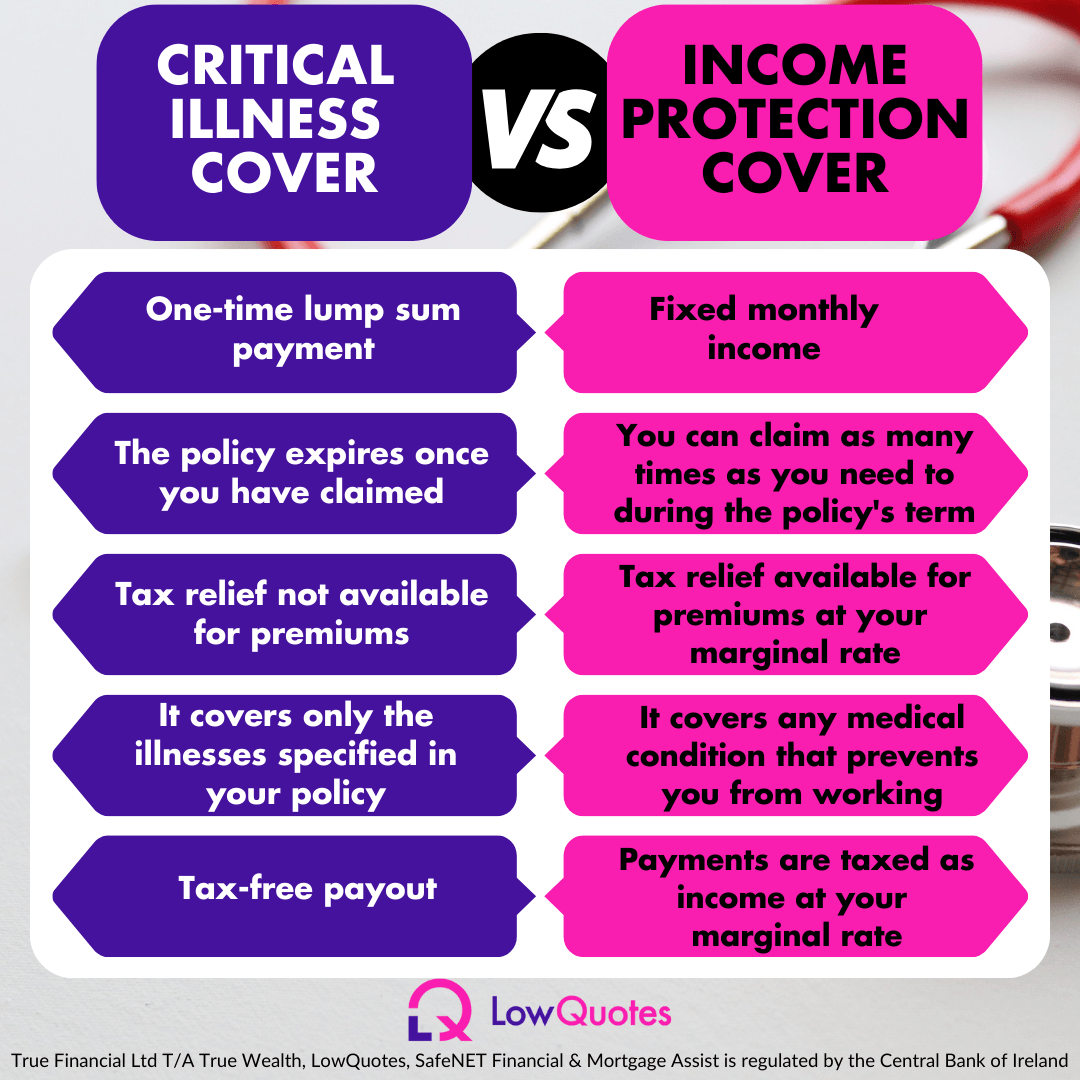

Image Source: lowquotes.ie

What are the Benefits of Critical Illness Insurance?

1. Financial Security: A critical illness insurance payout can provide the financial means to cover medical expenses, lost income, and other related costs. This can help alleviate the financial strain on you and your family during a difficult time.

2. Peace of Mind: Knowing that you have a financial safety net in place can provide peace of mind and reduce stress. It can give you the freedom to focus on your recovery without worrying about financial burdens.

3. Flexibility: Critical illness insurance policies often offer flexibility in terms of the payout options. You may have the choice to receive a lump sum payment or opt for regular payments over a specified period.

4. Tax Benefits: In many cases, critical illness insurance payouts may be tax-free. This can further enhance the financial benefits of the policy.

What Are the Different Types of Critical Illness Insurance?

There are several types of critical illness insurance policies available, each with its own unique features and benefits:

1. Standalone Critical Illness Insurance: This is a separate policy that provides coverage for critical illnesses only.

2. Rider on a Life Insurance Policy: Some life insurance policies offer critical illness insurance as a rider, providing additional coverage at an extra cost.

3. Group Critical Illness Insurance: This type of policy is typically offered through employers or organizations.

How to Choose the Right Critical Illness Insurance Policy

When selecting a critical illness insurance policy, it is essential to consider the following factors:

1. Coverage Amount: Determine the appropriate coverage amount based on your financial needs and the potential costs associated with your chosen critical illnesses.

2. Waiting Period: Some policies have a waiting period before benefits become payable. Consider the waiting period and ensure it aligns with your needs.

3. Definition of Critical Illness: Review the policy’s definition of critical illness to ensure it covers the conditions you are most concerned about.

4. Exclusions: Be aware of any exclusions or limitations in the policy. Some policies may exclude certain conditions or have specific criteria for coverage.

5. Premium: Compare premiums from different insurers to find the most affordable option that meets your needs.

Critical illness insurance is a valuable financial tool that can provide a much-needed safety net during times of adversity. By understanding the benefits and features of this type of insurance, you can make an informed decision and protect yourself and your family from the financial challenges associated with critical illnesses.

Critical illness insurance is a financial safety net designed to provide a lump sum payment upon diagnosis of a covered critical illness. This payment can be used to cover medical expenses, lost income, or other expenses associated with the illness. However, with so many different plans available, it can be overwhelming to choose the right one. In this article, we’ll explore the key factors to consider when selecting a critical illness insurance plan.

1. Understanding the Coverage

The first step in choosing a critical illness insurance plan is to understand the specific illnesses covered. Most plans include common critical illnesses such as heart attack, stroke, cancer, and kidney failure. However, some plans may also cover less common conditions, such as Parkinson’s disease or Alzheimer’s disease. It’s important to review the plan’s definition of each illness to ensure it aligns with your needs.

2. Considering the Benefit Amount

The benefit amount is the lump sum payment you will receive upon diagnosis of a covered critical illness. The amount should be sufficient to cover your anticipated expenses, including medical bills, lost income, and other costs. It’s important to consider your current financial situation and future needs when determining the appropriate benefit amount.

3. Evaluating the Waiting Period

The waiting period is the time that must elapse between the policy purchase date and the onset of a covered illness before benefits are paid. Waiting periods can vary from 30 days to several years. A shorter waiting period generally results in a higher premium, while a longer waiting period may offer more affordable premiums.

4. Understanding the Benefit Payment Options

Some critical illness insurance plans offer different benefit payment options. For example, some plans may allow you to receive a portion of the benefit upfront and the remaining balance in installments. Others may offer a lump sum payment. Consider your financial situation and preferences when choosing a payment option.

5. Assessing the Premium

The premium is the amount you will pay for your critical illness insurance coverage. Premiums can vary depending on several factors, including your age, health, lifestyle, and the type of plan you choose. It’s important to compare premiums from different insurers to find the most affordable option that meets your needs.

6. Reviewing the Exclusions

Critical illness insurance plans may have exclusions that limit coverage for certain conditions or circumstances. For example, some plans may exclude pre-existing conditions or illnesses that develop within a specific timeframe after policy purchase. Carefully review the plan’s exclusions to ensure they do not affect your coverage.

7. Considering the Insurer’s Reputation

The insurer’s reputation is an important factor to consider when choosing a critical illness insurance plan. Look for an insurer with a strong financial rating and a history of providing excellent customer service. You can research insurers online or contact a financial advisor for recommendations.

8. Understanding the Renewal Provisions

Some critical illness insurance plans have renewable provisions that guarantee your coverage, even if your health deteriorates. Other plans may be non-renewable, meaning the insurer may choose not to renew your coverage at the end of the policy term. Be sure to understand the renewal provisions of the plan you are considering.

9. Considering Rider Options

Many critical illness insurance plans offer optional riders that can enhance your coverage. For example, some riders may provide additional benefits for specific illnesses or disabilities. Consider your individual needs and preferences when evaluating rider options.

10. Consulting a Financial Advisor

A financial advisor can help you navigate the complexities of critical illness insurance and choose a plan that best suits your needs. They can provide personalized advice and recommendations based on your financial situation and goals.

Critical Illness Insurance: Protecting Your Finances