Imagine this: You’re sitting on your porch, sipping a cool drink, and watching the world go by. It’s a perfect summer day, and everything seems just right. Then, suddenly, a gust of wind sweeps through, knocking over your favorite potted plant. It crashes to the ground, shattering into a thousand pieces.

Ouch.

Now, imagine that you have home insurance. Instead of feeling devastated, you can simply pick up the phone, give your insurance company a call, and file a claim. A few days later, you’re enjoying your porch again, this time with a brand-new plant.

See? Insurance can be your best friend in the most unexpected of times.

But what exactly is insurance, anyway?

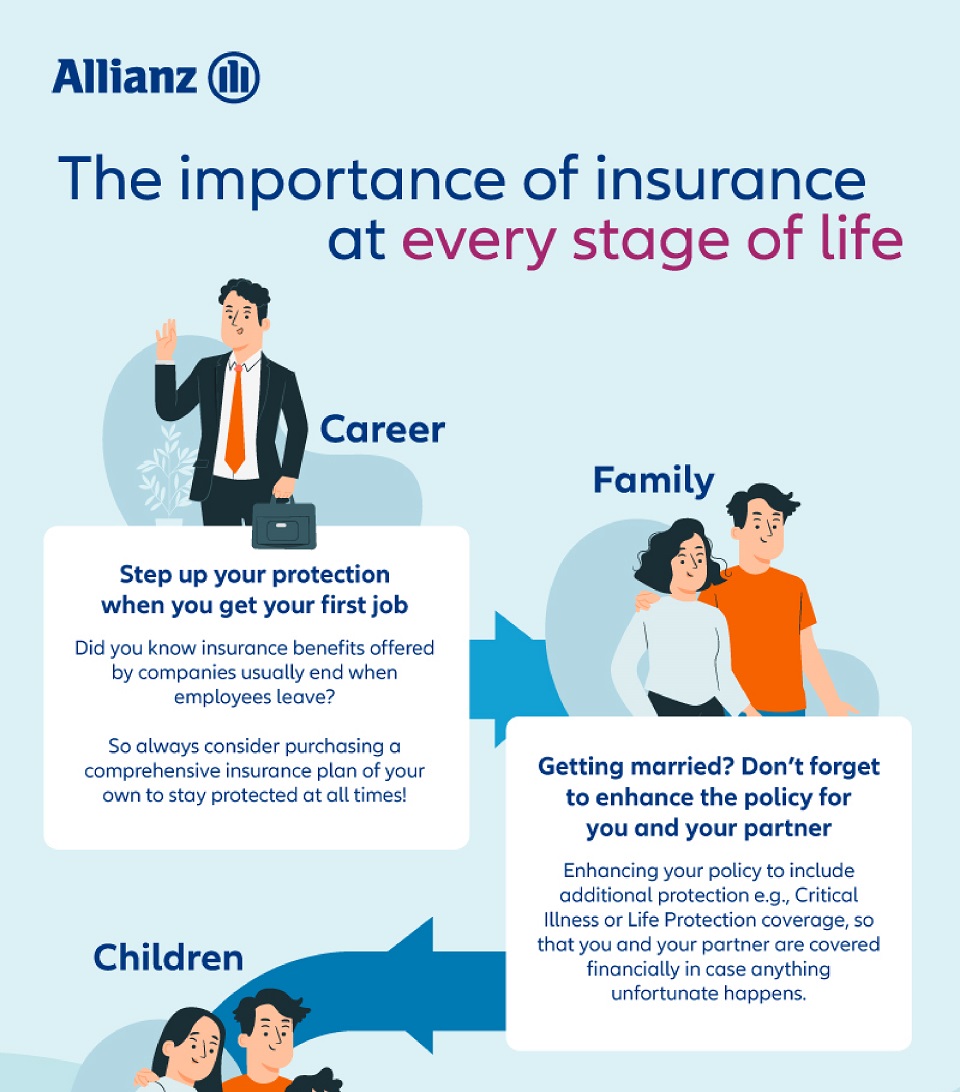

Image Source: allianz.com.my

Think of insurance as a safety net. It’s there to catch you when life throws you a curveball. For example, if you get into a car accident, your car insurance will help cover the cost of repairs or a new car. If your house gets damaged in a storm, your home insurance will help you rebuild. And if you get sick or injured, your health insurance will help cover the cost of medical treatment.

So, why should you get insurance?

Peace of mind: Knowing that you’re protected can help you relax and enjoy life more.

But insurance isn’t just for big emergencies. It can also help you with smaller, everyday problems. For example, if you lose your keys or your phone, your renters insurance may cover the cost of replacements. And if you get a flat tire, your car insurance will help you get back on the road.

So, how do you choose the right insurance?

The best way to find the right insurance for you is to shop around and compare prices. You can also talk to a qualified insurance agent who can help you find the best policy for your needs.

Remember, insurance is a tool, not a guarantee. It can’t prevent accidents or disasters from happening. But it can help you recover from them. So, the next time you’re feeling a little anxious about the future, remember that you have insurance. It’s your BFF, always there to catch you when you fall.

Imagine this: you’ve just spent months transforming your living room into a cozy haven. Fresh paint, new furniture, and a curated collection of art pieces. It’s your personal sanctuary. Then, a sudden storm rolls in. The roof leaks, and water seeps through, ruining your beloved belongings. It’s a nightmare, isn’t it?

But what if we told you there was a magical shield, a protective force that could have saved your day? That’s where home insurance comes in. It’s like having a personal guardian angel watching over your home, ready to swoop in and save the day when disaster strikes.

So, what exactly does home insurance cover?

Think of it as a safety net. It protects you against a wide range of unexpected events, from natural disasters like fires, floods, and earthquakes to man-made incidents like theft and vandalism. It’s like having a financial cushion to fall back on when life throws you a curveball.

But why do you need it if you’re careful and cautious?

Accidents happen, no matter how careful you are. A burst pipe, a faulty electrical wiring, or even a simple kitchen fire can cause significant damage to your home and belongings. Home insurance ensures that you’re not left financially burdened in such situations.

What about the cost?

The premium you pay for home insurance depends on various factors, including the size of your home, its location, the value of your belongings, and your coverage options. But don’t let the cost deter you. It’s a small price to pay for peace of mind.

So, how do you choose the right home insurance policy?

It’s important to shop around and compare different policies to find one that suits your needs and budget. Consider factors like coverage limits, deductibles, and exclusions. And don’t hesitate to ask questions. Your insurance agent is there to help you understand the policy and make informed decisions.

But what if you’re a renter instead of a homeowner?

Don’t worry, renters insurance has you covered. It protects your personal belongings and offers liability coverage in case someone gets injured on your property. It’s a great way to safeguard your investments and avoid financial ruin.

In conclusion,

Home insurance is more than just a financial product. It’s a safety net that can provide you with peace of mind and financial security. So, don’t let the fear of the unexpected ruin your enjoyment of your home. Protect yourself with the magic of home insurance and let the sun shine on your life, rain or shine.

The Importance of Insurance in Your Life